2024

NACA Builds Affordable Modular Homes

NACA builds high quality affordable factory-assembled modular homes in Selma Alabama. The first homes have revitalized Washington Street which was devastated by a tornado in 2023.

Access your file to provide information, upload documents and check your status

Member portal login

Log in to view events, sign up for volunteer opportunities, and more.

NACtivist login

Access your file to provide information, upload documents and check your status

Member portal login

Log in to view events, sign up for volunteer opportunities, and more.

NACtivist login

NACA has established the most effective affordable homeownership programs in the country through NACA’s aggressive advocacy and state-of-the-art operations. Although NACA’s homeownership programs may sound too good to be true, NACA has made affordable homeownership a reality and continues to advocate and set the national standard for affordable homeownership.

NACA builds high quality affordable factory-assembled modular homes in Selma Alabama. The first homes have revitalized Washington Street which was devastated by a tornado in 2023.

NACA does 19 simultaneous purchase events in rural communities in Alabama and the black belt during the four-day Dr. Martin Luther King Jr holiday Weekend.

NACA is implementing an innovative solution to address the unaffordable housing market via large-scale construction of factory-assembled, modular homes.

NACA Members can navigate the homebuying process with unprecedented effectiveness by putting much of the control in the Member’s hands.

NACA also integrates the efficiency of accessing bank data directly from financial institutions, eliminating the Member’s need to manually upload credit and bank statements.

NACA offers a 20-year mortgage product with an unprecedented below market interest rate.

NACA reaches over $20 Billion in commitments to its Best in America Mortgage with $15 Billion from Bank of America.

NACA establishes state-of-the-art remote comprehensive housing system to assistance both homebuyers and renters. NACA does not layoff or reduce it operations during the pandemic providing about 30% of the housing counseling in the country.

Does thirteen events nationwide. Through word of mouth, without outreach or media, many thousands of homebuyers attend including over 20,000 in New York City.

NACA makes homeownership for Section 8 Housing Choice Voucher recipients possible and affordable through NACA’s Homeownership through Public Housing Assistance (“HOT-PHA”) program. Recipients can use the Payment Standard now generating wealth for their landlord, to create hundreds of thousand dollars in wealth for themselves in less than twenty years.

Purchase program is expanding after the financial crisis with over 4,500 closing loans with NACA’s Best in America Mortgage.

NACA is the first to provide 150% loan-to-value (“LTV”) mortgages in Detroit where purchase prices are significantly higher than appraised values. The Detroit Free Press writes an editorial about the NACA mortgage titled “Mortgage Program is Key to Detroit’s Future”.

NACA works with the OCC to provide a standard for high LTV mortgages in low-value market areas where purchase prices exceed the value of existing properties.

NACA visits every member of Congress with hundreds of Members and staff to educate and remind them of NACA’s outstanding homeownership programs and advocacy in their districts and nationwide.

NACA defeats CFPB who now addresses NACA’s concerns and is supportive of NACA’s homeownership programs.

Negotiates new agreements with CitiMortgage and Bank of America to make additional buy-down funds available for low to moderate income borrowers.

NACA introduces the revolutionary fifteen-year Wealth Builder Mortgage.

Demonstration at CFPB headquarters in D.C. with over 1,000 people shutting down their operations to protest CFPB’s refusal to assist the many thousands of homeowners who have been denied modifications from their lenders.

NACA completes Save-the-Dream event tour 24 events this year. NACA completed 144 events nationwide over five plus years assisting over 500,000 homeowners save their homes with an affordable solution and setting the national standard in assisting at-risk homeowners.

NACA continues with Save-the-Dream events with 43 events nationwide.

Bank of America adds $3 Billion to its commitment to NACA’s Best in America Mortgage.

NACA Defeats Chase signing an agreement with NACA offering one of the best restructuring solutions for at-risk homeowners.

NACA sues and defeats NeighborWorks over its mismanagement of the one-billion-dollar Emergency Homeowner Loan Program (EHLP) resulting in $750 million being returned to the government and many thousands of homeowners losing their homes.

HUD’s Inspector General issues report recognizing NACA’s outstanding work with no finding or recommendations after months evaluating NACA’s programs. NACA defeats HUD after NACA sues HUD and the Justice Department has HUD compensate NACA.

NACA achieves affordable solutions for at-risk homeowners through legally binding agreements with all the major servicers, lenders, and investors covering the vast majority of at-risk homeowners, including Bank of America, Wells Fargo, Citigroup, Chase, American Homes Servicing, Litton, GMAC, OneWest/IndyMac, IBM, Saxon, HSBC, Ocwen and the two major investors Fannie Mae and Freddie Mac. NACA is so successful that virtually all the servicers and investors cooperate with NACA.

The Save-the-Dream Tours continue with events throughout the country providing the most effective solutions for large numbers of homeowners with an unaffordable mortgage. These free events set the national standard for affordable long-terms solutions with many thousands of homeowners receiving same day solutions permanently reducing their interest rate to as low as 2% and having the outstanding principal reduced. Homeowners save hundreds of dollars, even thousands of dollars on their monthly mortgage payment.

NACA continues its advocacy campaign against Chase which is the only major servicer refusing to provide long-term affordable solutions. NACA stormed Chase’s corporate offices on Wall Street with thousands of homeowners and works with Chase’s regulator, the OCC, in addressing thousands of Chase complaints.

NACA initiates Predators Tour on February 8th in Greenwich Ct. to hold the financial executives personally responsible for the mortgage crisis and their refusal to provide long-term affordable solutions.

Over 350 homeowners protest at the homes of John Mack, the CEO of Morgan Stanley, and Bill Frye, the CEO of the hedge fund Greenwich Capital. The impact is dramatic in holding these executives personally responsible by bringing the consequences of their actions to their doorsteps in a confrontational but non-violent manner.

NACA’s first historic Save the Dream Event providing affordable solutions for at-risk homeowners takes place at the Capital Hilton Hotel in Washington D.C. for five days from July 19th to 23rd with over 300 NACA Counselors. First of many events over the next five years.

Over 20,000 people participate and NACA modifies thousands of homeowners’ loans.

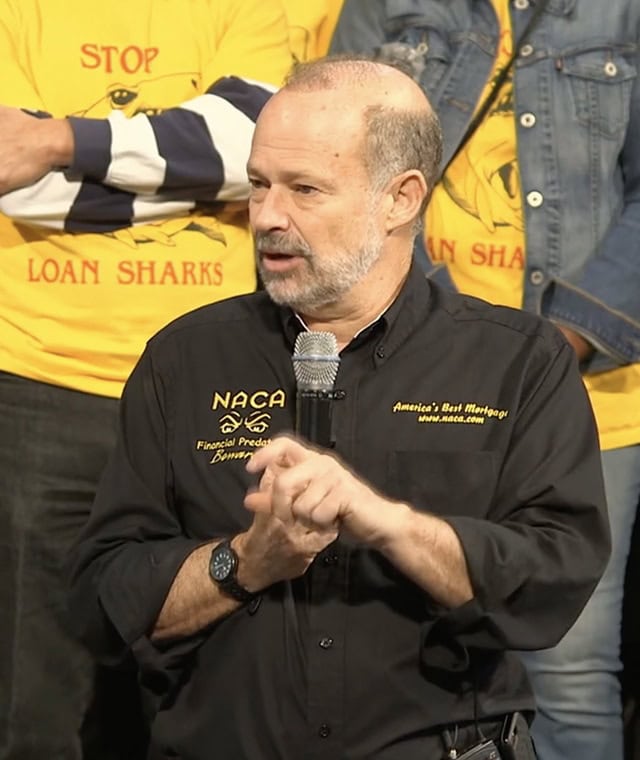

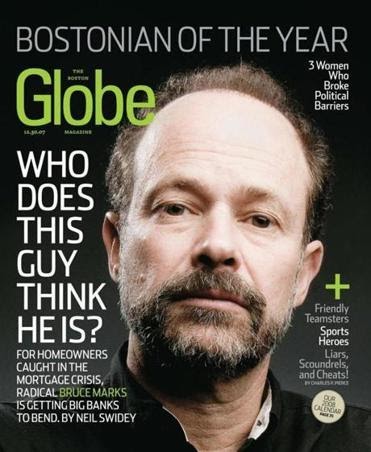

Bruce Marks named 2007 “Bostonian of the Year” being the first community activist.

NACA launches Home Save Program to assist homeowners at risk of foreclosure with a one-billion-dollar commitment to refinance homeowners out of their unaffordable loans and working with lenders to modify loans on terms that the homeowners can afford over the long-term.

Citigroup’s CEO Chuck Prince visits NACA’s national office to get a first-hand demonstration of the NACA program and NACA-Lynx. Other lenders follow suit.

NACA unveils its state-of-the-art, web-based counseling and mortgage application processing software called NACA-Lynx that has been years in the making.

Citigroup begins a new partnership with a commitment of $3 billion to the NACA purchase program and improves the lending practices of CitiFinancial.

Bank of America provides another $3 billion to the program, bringing its total commitment to $6 billion.

NACA mobilizes thousands of Members to work with Georgia Governor Roy Barnes to pass the nation’s strongest protections against predatory lending.

Georgia legislation provides borrowers with relief from exorbitant fees and interest rates, prepayment penalties, and balloon payments.

NACA defeats Associates/Ford after four-year campaign of organizing, media exposés on programs like ABC Prime Time Live, and disrupting Ford’s annual meeting.

Associates agree to a mortgage reduction program that automatically reduces interest rates for customers providing billions in customer savings revolutionizing the sub-prime market and commits $100 million to the NACA purchase program.

Bank of America commits $3 Billion to the NACA Program after review of NACA’s impressive results.

NACA contacts over 100,000 Associates/Ford borrowers, organizes demonstrations where Ford does business, and fills federal court hearings to overcapacity.

NACA convinces the federal judge to throw out an Associates/Ford settlement, which would have provided them with immunity while enriching the lawyers and leaving the victims with only $50 each.

First Union agrees to provide $150 million for the NACA program.

Signet and Riggs Banks negotiate agreements with NACA.

Over ten thousand people in Atlanta attend the largest homeownership event in America at the First Iconium Baptist Church.

Hugh McColl impressed with NACA’s purchase program, commits $500 million from NationsBank as NACA’s biggest lending partner.

NACA confronts Fleet CEO Terrence Murray at a Harvard Business School event.

NACA defeats Fleet after a four-and-a-half year war, Fleet gives in to NACA’s demands and agrees to an $8 billion community reinvestment program, settles lawsuits for over $350 million, and funds NACA’s revolutionary mortgage program with $140 million.

NACA conducts a two-and-a-half -year research and advocacy campaign against second mortgage scams, which leads to an investigation by the Massachusetts Attorney General.

Over 400 newspaper articles and many more TV news reports document these unscrupulous practices against working people.

NACA conducts a two-and-a-half -year research and advocacy campaign against second mortgage scams, which leads to an investigation by the Massachusetts Attorney General.

Over 400 newspaper articles and many more TV news reports document these unscrupulous practices against working people.

NACA initiates the Second Mortgage Scam Campaign against the financial institutions which targeted minority homeowners with high equity through unscrupulous “home improvement”.

Coins the term “Predatory Lending”.

UNAC/NACA initiates campaign against financial institutions that targeted minority homeowners with high equity through unscrupulous “home improvement” companies (i.e. “Second Mortgage Scam Campaign”).

On April 18, 1990, President George Bush signs an amendment to Taft-Hartley into law after Local 26’s national advocacy campaign. This allows housing assistance as part of union and management negotiations. It is the first change to the Taft-Hartley Act in over 30-years, and the first time a local union got the Act changed.

After a three-year public campaign, the Hotel Workers Union in Boston negotiates the first ever housing trust fund with hotel management. This provides hotel workers with down-payment and other assistance in fulfilling the dream of homeownership. The contract requires an amendment to the federal Taft-Hartley Act.

The Union Neighborhood Assistance Corporation is founded and later transitioned into NACA.

Get the latest news on how to get involved with NACA.